Action 4 - OECD BEPS

Action 3 - OECD BEPS

Home OECD iLibrary

Base erosion and profit shifting - OECD BEPS

For the Record : Newsletter from Andersen : May 2015 : Addressing International Tax Planning in the Changing BEPS Landscape

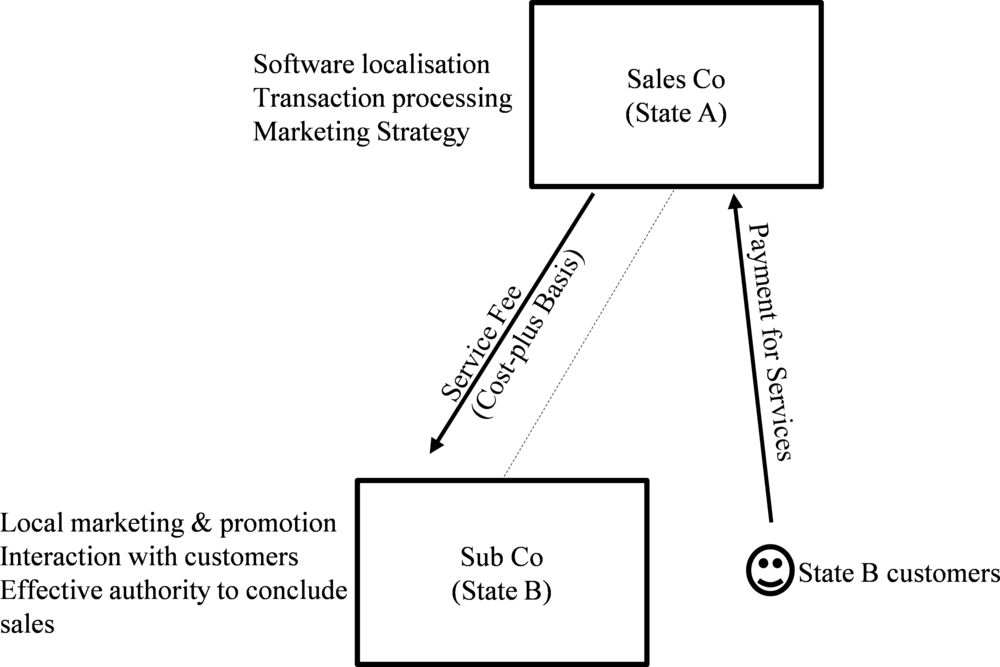

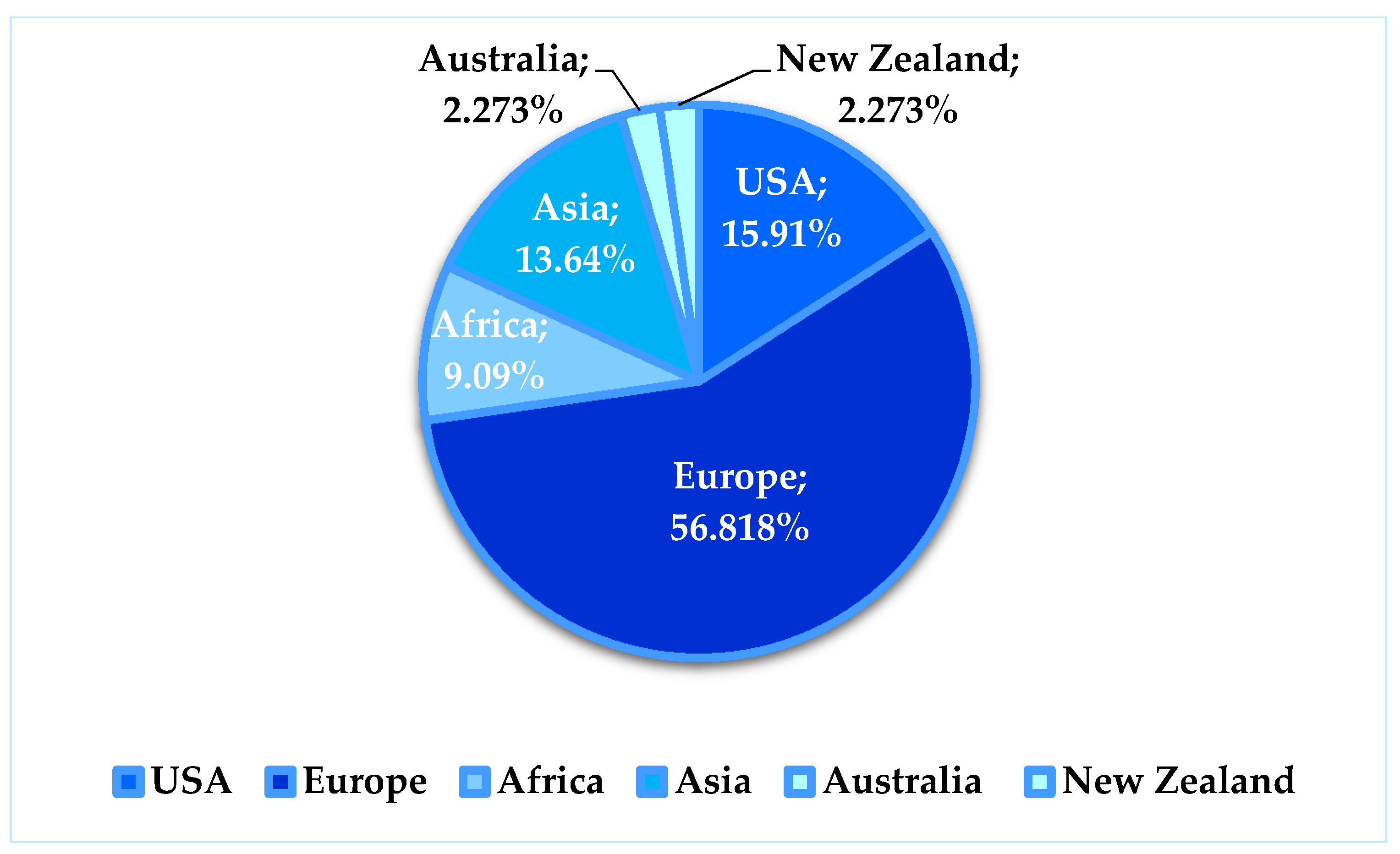

Sustainability, Free Full-Text

OECD Base Erosion and Profit Shifting Documentation - Treasury Improvement

The mobility and fungibility of money makes it possible for multinational groups to achieve favourable tax results by adjusting the amount of debt in

Oecd/G20 Base Erosion and Profit Shifting Project Limiting Base Erosion Involving Interest Deductions and Other Financial Payments, Action 4 - 2016

Addressing base erosion and profit shifting (BEPS) is a key priority of governments. In 2013, OECD and G20 countries, working together on an equal

Oecd/G20 Base Erosion and Profit Shifting Project Limiting Base Erosion Involving Interest Deductions and Other Financial Payments, Action 4 - 2015

BEPS Reports - OECD