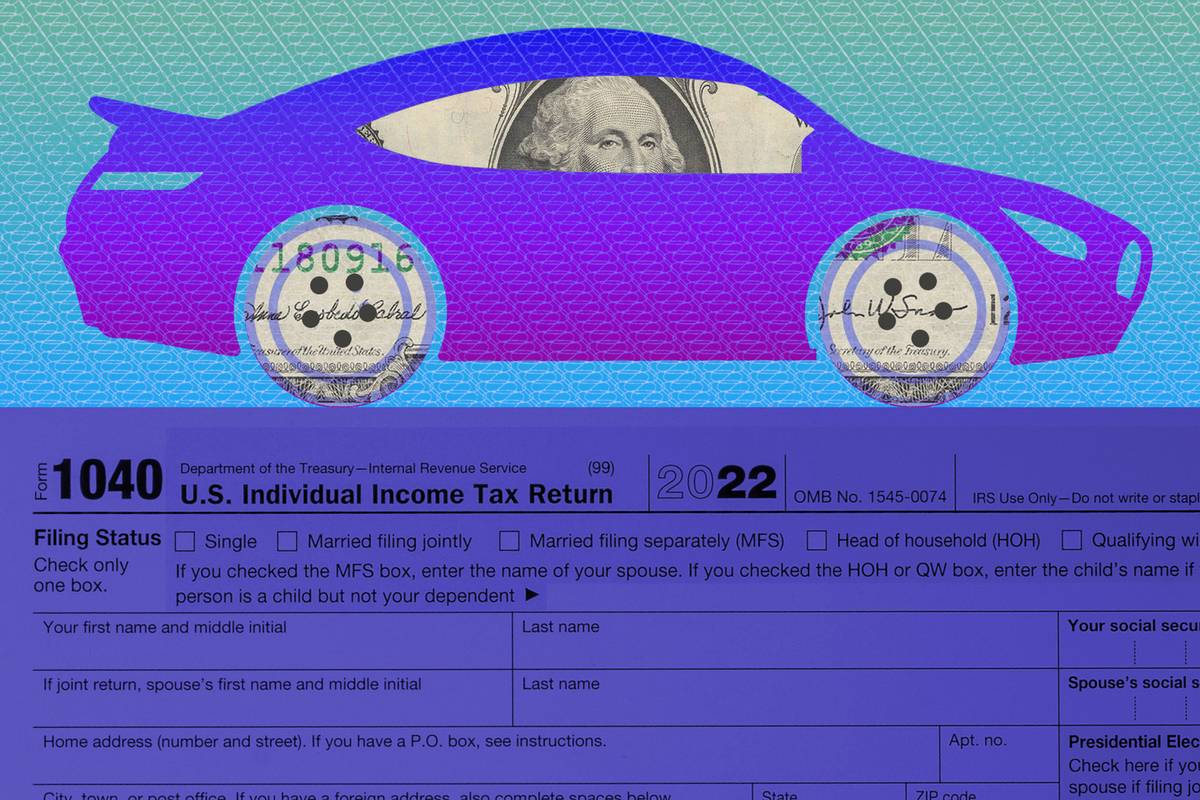

Is Buying a Car Tax Deductible?

There are several scenarios where shoppers can qualify for a tax deduction or a tax credit for a vehicle purchase.

Budget 2019 FM Nirmala Sitharaman proposes income tax deduction on purchase of electric vehicles

Section 80EEB Deduction on purchase of electronic vehicle

)

Why should luxury cars owned by social institutes get tax benefits, CAG ask

CMO Odisha on X: With an aim to encourage faster adoption of electric vehicles in #Odisha, the State Govt has allowed 100% exemption on motor vehicle (MV) tax and registration fees for

How to Write Off Your Car As a Small Business Owner

Is personal loan interest tax deductible?

GST on electric vehicles set to be slashed from 12% to 5% - The Economic Times

)

To buy or lease? Leasing car beneficial for business owner than individual

How to calculate vehicle tax depreciation

Is Buying a Car Tax-Deductible in 2024?

Before buying an EV car, know how to get tax exemption, know 11 important things - Bollywood Wallah

What Is a Write-Off? Definition & Examples for Small Businesses